By Matt Smith, CNN

updated 6:39 PM EST, Mon December 31, 2012

STORY HIGHLIGHTS

- The fiscal cliff is nigh, but a deal is "very, very close," Senate GOP leader says

- Obama says more work will be needed and chides Congress for dragging its feet

- A possible agreement calls for increase in income, estate taxes

- The fiscal cliff triggers broad tax increases and an automatic $110 billion in spending cuts

(CNN) -- The feared fiscal cliff was at hand Monday night, with nothing expected to pass Congress before a combination of tax increases and spending cuts starts to kick in at midnight.

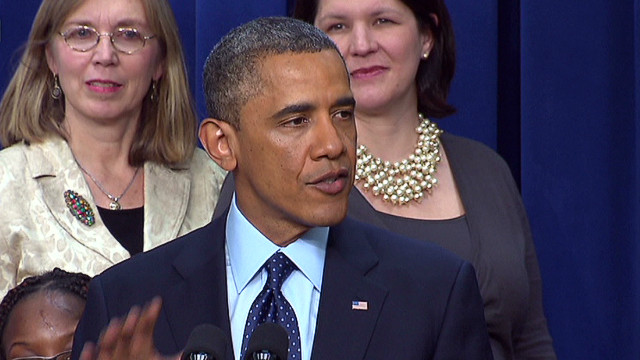

A deal to avert that combination, which economists warn could push the U.S. economy back into recession, was "within sight" on Monday afternoon, President Barack Obama said. And in the Senate, Minority Leader Mitch McConnell told members that they were "very, very close" to a deal, having worked out an agreement on taxes.

Sen. Kay Bailey Hutchison, R-Texas, said senators "are hoping to vote tonight" on some package to avert the cliff. But the House of Representatives adjourned without voting on anything Monday -- and Obama's remarks earlier Monday, in which he chided Congress and warned that battles over spending still loomed, hit a nerve among several Republicans in the Senate.

"They are close, but they're not there yet," Obama said. "And one thing we can count on with respect to this Congress is that if there is even one second left before you have to do what you're supposed to do, they will use that last second."

Obama said the deal now on the table would prevent a tax increase for the overwhelming majority of Americans, extend the child tax and tuition credits for families as well as those for clean-energy companies, and extend unemployment benefits for 2 million people. But even then, he said lawmakers still have to figure out how to mitigate the possible damage from sharp spending cuts that are scheduled to start biting January 2, when the federal government reopens after the New Year's holiday.

And he warned that if Republicans think they can get future deficit reduction solely through spending cuts "that will hurt seniors, or hurt students, or hurt middle-class families without asking also equivalent sacrifice from millionaires or companies with a lot of lobbyists ... they've got another think coming."

That combative talk drew anger from Republican senators who have been grappling for a deal with the Democratic majority in that chamber. Sen. Bob Corker, R-Tennessee, called the president's comments "very unbecoming of where we are at this moment" and added, "My heart's still pounding."

"I know the president has fun heckling Congress," Corker said. "I think he lost probably numbers of votes with what he did."

And Sen. John McCain said Obama "sent a message of confrontation to Republicans" with his remarks.

"People have to wonder whether the president really wants issue resolved, or is it in his short-term political benefit for us to go over the cliff," said McCain, R-Arizona.

The nonpartisan Congressional Budget Office has predicted the combined effect of the tax increases and budget "sequestration" -- across-the-board budget cuts set up as part of the 2011 standoff over raising the federal debt ceiling -- could dampen economic growth by 0.5%. That could tip the U.S. economy into a recession and driving unemployment from its current 7.7% back over 9%, the CBO estimated.

The tax proposals under discussion late Monday call for rolling back tax rates on the highest-income earners to Clinton-era levels, increasing the estate tax rate, extending unemployment benefits and potentially putting off the $110 billion in automatic spending cuts called for in the legislation that created the cliff, according to sources close to the process.

A source familiar with the negotiations said the proposal under discussion would generate $600 billion in revenues by ending the Bush-era tax cuts on individuals with incomes above $400,000 and families over $450,000. Their tax rate would be 39.6%, the same as it was in 2000 during President Bill Clinton's presidency. The top income rate is currently 35%.

The deal would also increase the estate tax to 40% from the current 35% level and cap itemized deductions for individuals with incomes above $250,000 and household income over $300,000, the source said.

In the House, GOP sources said there's little practical difference in settling the issue Monday night versus Tuesday. But if House Republicans approve the bill on Tuesday -- when taxes have technically gone up -- they can argue they've voted for a tax cut to bring rates back down, even after just a few hours, GOP sources said. That could bring some more Republicans on board, one source said.

Earlier, a GOP source told CNN that the sticking point in talks was $24 billion in spending cuts being sought by Republicans in place of deeper cuts.

"It's like looking under the cushions at this point," the source said. "If we can't find that at this point, we should pack this place up."

As Monday's deadline drew nigh, federal agencies were preparing for the possibility of furloughing workers. At the Pentagon, a Defense Department official said as many as 800,000 civilian employees could be forced to take unpaid days off as the armed services face an expected $62 billion in cuts in 2013 -- about 12% of its budget.

Those workers perform support tasks across the department, from maintaining aircraft and weapons systems to processing military payrolls and counseling families. The Pentagon believes it can operate for at least two months before any furloughs are necessary, but has to warn its civilian workforce that furloughs could be coming, the official said.

The White House budget office noted in September that sequestration was designed in 2011 as "a mechanism to force Congress to act on further deficit reduction" -- a kind of doomsday device that was never meant to be triggered. But Congress failed to substitute other cuts by the end of 2012, forcing the government to wield what the budget office called "a blunt and indiscriminate instrument."

Republicans want a three-month delay, while Democrats seek to forestall the cuts by one year, a Democratic source told CNN. Another Democratic source said the proposed three-month delay "can't pass."

Despite Obama's backing, one leading Senate Democrat warned a deal could run into trouble -- not only from House Republicans who have long opposed any tax increase, but also from liberals in the Senate who oppose allowing more high-income households to escape a tax increase.

"No deal is better than a bad deal, and this looks like a very bad deal the way this is shaping up," Sen. Tom Harkin, D-Iowa, said.

CNN's Mike Pearson, Jessica Yellin, Dana Bash, Deirdre Walsh, Lisa Desjardins, Ted Barrett and Ashley Killough contributed to this report.

No comments:

Post a Comment